IRS Audit

The IRS will send you letter 6323 indicating that they would like to review your tax return & to call. This process can be quite stressful, as the IRS has the power to make changes to your taxes if they find anything incorrect. An IRS audit is a serious matter, and it's important to seek out professional help to ensure that everything is handled correctly. We can help you can navigate the audit process and ensure that your rights are protected. We can review your tax return & IRS Audit letter

Call Today (949) 506-3457

An IRS audit is an examination of the tax returns of a taxpayer, business, or a non-profit the Internal Revenue Service (IRS). The IRS selects certain taxpayers for audit based on various criteria, including income level, type of business, and deductions claimed.

According to the IRS, The main purpose of an IRS audit is to ensure that you have correctly reported income and claimed deductions and credits on the tax return. The IRS may also examine your records to ensure that the income and deductions reported on the tax return are consistent with the records.

The penalties that can be added as a result of an IRS audit include the fraud penalty, accuracy-related penalty, and failure to pay penalty. The IRS may also reverse credits claimed on the tax return.

The IRS Audits self-employed, Homeowners, real estate investors & small business owners. IRS can also audit IRS employees. IRS uses both computerized & manual selection processes for audits. IRS may select a return for examination because it appears to be incorrect or incomplete.

-

Field audits are the most comprehensive and are conducted by an IRS revenue agent. The agent will want to come to your office or place of business to review your records. Desk audits are less comprehensive and are conducted by mail. The IRS will request that you send specific documentation to support the items on your return. Correspondence audits are the least comprehensive and are also conducted by mail. With this type of audit, the IRS will request all information by mail or fax.

-

The IRS Audits self-employed, Homeowners, real estate investors & small business owners. IRS can also audit IRS employees. IRS uses both computerized & manual selection processes for audits. IRS may select a return for examination because it appears to be incorrect or incomplete.

-

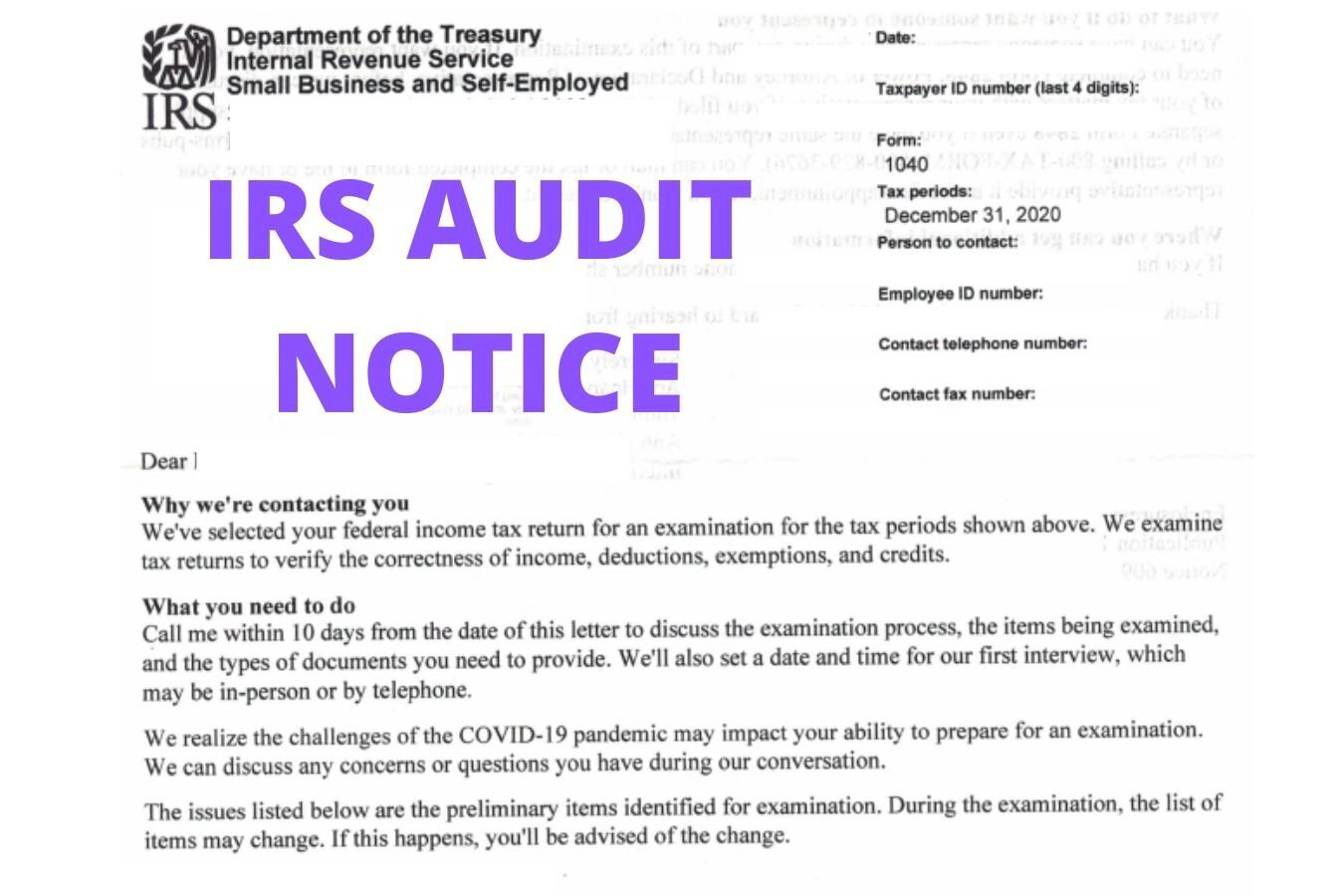

The IRS will send a letter notifying the taxpayer that the tax return has been selected for audit. The letter will provide information about how to schedule an appointment for an interview with an IRS representative.

You will then have 10 days to respond to the IRS Audit Letter to schedule an appointment. If you do not respond, the IRS will send another letter requesting that the taxpayer schedule an appointment for an interview. If the taxpayer does not respond to this letter, the IRS will take enforcement action against the taxpayer.

If you agree to an interview, he or she will go to an IRS office and meet with an IRS representative. The representative will ask to see records supporting the income and deductions reported on the tax return. The representative may also ask questions about how the income was earned and how the expenses were incurred.

-

The IRS audits because they are reviewing if you underreported income and overstated expenses. IRS revenue agents will look at your bank deposits to get an idea of your true income. IRS may ask for business records such as receipts, canceled checks, invoices & bank statements.

For self-employed individuals, IRS will want to see a copy of your Schedule C which is filed with your personal 1040 tax return.

Homeowners' IRS will want to see proof of mortgage interest and real estate taxes paid. Real Estate investors IRS will want to see documentation on depreciation taken on the property. Small business owners IRS will want to review the business records such as inventory, receipts & profit & loss statements. IRS employees the IRS will want to see W-2 forms & IRS employment records.

-

It's important to keep in mind that the IRS can only audit your taxes within three years of when they were filed. After that, the statute of limitations expires and the IRS can no longer make any changes. If you are facing an IRS audit, it's important to seek out professional help to ensure that everything is handled correctly.

-

The IRS changes your tax return by adding the under-reported income and reducing expenses. IRS will also charge you penalties & interest. The changes the IRS on your taxes are on Form 4549 or Form 886-A. IRS will mail the form to you & give you 30 days to appeal the changes. If you believe that the IRS audit is wrong, you have the right to appeal the decision. The IRS has a process in place for appeals, and it's important to follow the proper steps in order to ensure that your appeal is heard.

You submit your appeal within 30 days by sending in written disagreement to the IRS revenue agent or requesting a Manager's conference. You will send IRS supporting documentation to prove that their audit is incorrect. IRS will review your case and make a determination.

The IRS finalizes the Audit by sending out a notice of deficiency.

IRS will give you 90 days to file a petition in Tax Court. If you still disagree with the Notice of deficiency, this is how you petition the tax court