Looking to settle your IRS Back Taxes?

Settle Your IRS Tax Debt with an Offer in Compromise

The IRS OIC eliminates your tax debt for less than what you owe.

We have settled out Millions of Dollars on behalf of our clients with the offer in compromise program. We can see if you qualify.

Let’s start with a Free Case Review. Call 24/7 or fill out the Form to get started.

The IRS Offer In Compromise Program or OIC is considered to be the best IRS tax relief program since the OIC completely gets rid of your IRS tax debt. The OIC is an IRS forgiveness program and is an IRS front-end Tax Debt Settlement Solution with the IRS.

There are qualifications you have to meet to file an IRS OIC,

How do I qualify to settle my IRS tax debt through the IRS Offer In Compromise?

One of the best ways to settle your IRS back taxes is through the IRS Offer In Compromise program.

THE IDEA MAY SEEM SIMPLE, WHICH IS TO OFFER THE IRS AN AMOUNT, IN WHICH YOU REQUEST THE IRS TO FORGIVE THE REST OF THE TAXES.

-

An example of this is: You owe the IRS $15,000 in back taxes, and you offer them $100. If they accept the offer in compromise, you will save $14,900. So, this settlement solution might be very appealing.

Is there a catch? Well, it is a compromise! If the IRS might consider forgiving your past taxes, you have to take steps before applying to the Offer in Compromise.

What are the steps required prior to applying for an Offer in Compromise?

File Tax Compliance all missing tax returns

Have enough current taxes taken out the current year.

Organize your current financials

In order to have the IRS even consider forgiveness, you have to get caught up with all of your tax filings. Even if you were to owe additional balances on the filings, the additional taxes may be included in the offer in compromise with the IRS.

When you submit an IRS OIC, you must have filed all of your tax returns. There can be no outstanding or missing Tax Filings. If you have not filed a tax return, it must be filed prior to submitting the OIC. All prior-year tax filings must be filed with the IRS. If you have any missing tax filings, the IRS will return the OIC, which is a very bad thing to happen on your file. If you have a missing tax filing, it is important to file right away, so that the IRS will not return the IRS Offer In Compromise.

If a past mistake has not been paying enough taxes, this has to absolutely be fixed:

Wage Earners (income from W2 wages), you will need to adjust your W 4 through work.

Self Employed & Business Owners, you will need to make Estimated Tax Payments

Organizing your financials is an extremely important step, as it will determine the type of Offer In Compromise to request from the IRS. In addition, your current financial situation will be used to calculate the offer amount.

How Does the IRS Offer in Compromise Work?

The components of the IRS OIC focuses on making an offer to the IRS, which if the IRS accepts, the rest of the IRS Tax Debt is eliminated. The highlights are below:

The IRS OIC focuses on your current finances

The IRS OIC Forms & Documents Required: IRS 433A-OIC, IRS 656, your Support Documents

Length processing time for the OIC: Approximately 7 months - 1.5 years.

Types of Offer in Compromise

How many types of Offer In Compromise does the IRS offer?

The IRS has 3 types of Offer In Compromise:

Doubt as to Collectibility

Doubt as to Liability

Effective Tax Administration

-

We are going to be breaking down the difference between each IRS Offer In Compromise. Determining which type of Offer in Compromise to apply for will be based on your personal circumstances to determine if you qualify.

The first type of Offer In Compromise program is the Doubt as to Collectibility, which is also known as the DATC OIC. The DATC Offer in Compromise is the most commonly filed type of offer in compromise with the IRS. The DATC OIC follows a formula that is based on your monthly disposable income & equity in assets. This formula is based on your current finances, and overall ability to re-pay the IRS not the amount of back taxes owed to the IRS. If you have sufficient monthly disposable income or equity in assets, then the IRS would disqualify you from the program.

The second Offer in Compromise is the Doubt as to Liability program which is also known as the DATL OIC. If you have a balance due with the IRS, which is incorrect, then you have to file your proof with the IRS that the amount owed is incorrect. The IRS DATL department will review all the substantiation submitted to see if the amount owed is incorrect and an adjustment is to be made to bring it down to the correct tax.

The third type of Offer in Compromise is the effective tax administration, which is not so commonly filed because of its complexity in nature. The Effective Tax Administration is also known as the ETA OIC. Filing for an ETA OIC follows the same procedure & forms that the Doubt as to collectibility offer in compromise. However, with an ETA OIC you might have enough income and or assets to pay off the IRS Liability, however you have special circumstances you need to address to the IRS which prevent you from paying off your taxes.

Qualifying for an Offer in Compromise - Doubt as to Collectibility:

As mentioned above, you will need to have your finances organized. Here at Semper Tax Relief, we use a simple client organizer that gets the information required.

What type of Information does the Offer In Compromise require you to disclose?

1-Your Household income sources

2-Household expenses

3-Equity in Assets

4-Liabilities

The basic qualification for an offer in compromise is a review of disposable income and any equity in assets. Once an Offer in Compromise gets submitted, the IRS will assign an agent to investigate the information submitted and make a determination on your offer. The IRS OIC procedure is navigating through muddy waters,a procedure i which we are familiar.

Verified IRS Offer in Compromise Acceptance

Do you qualify for the IRS Offer In Compromise Program? CALL TODAY (949) 506-3457

Rather Have us Call you? Click Below to Schedule Online!

IRS OIC Tax Forms

So you go through the motions of evaluating your IRS balance, and calculation and you have submitted the forms. An Important step is to keep track of what was sent. We use the USPS - and sent the OIC Packet with tracking. 30-60 days A letter confirms receipt of your OIC.

This letter has a future expected contact date. What this means is that the IRS will assign an IRS agent to your case. The IRS agent is known as Offer Examiner. The position title lets you know that they will be examining & investigating all of your information as provided in the Offer Packet.

The Agent will make a recommendation to accept or reject. If rejected you may appeal if you have the grounds, which gives you a second chance at the OIC with the office of appeals.

A tax attorney specializing in offers in compromise can help you navigate these requirements.

-

IRS Offer In Compromise Calculation: FORM 433A-OIC

THE IRS FORM 433AOIC, COLLECTION INFORMATION STATEMENT IS AN IMPORTANT FORM IF YOU ARE CONSIDERING MAKING AN OFFER IN COMPROMISE TO THE INTERNAL REVENUE SERVICE. THIS FORM ALLOWS THE IRS TO COLLECT DETAILED INFORMATION ABOUT YOUR ASSETS, LIABILITIES, INCOME, AND EXPENSES. IT IS IMPORTANT FOR YOU TO COMPLETE THIS FORM ACCURATELY AND HONESTLY, AS IT WILL HELP THE IRS DETERMINE WHETHER OR NOT YOU ARE ELIGIBLE FOR AN OFFER IN COMPROMISE.

If you are considering making an offer in compromise to the IRS, it is important that you complete the IRS FORM 433AOIC accurately and honestly. This form will help the IRS determine whether or not you are eligible for an offer in compromise.

The Internal Revenue Service (IRS) has very specific guidelines when it comes to Offer in Compromise (OIC) settlements. Because of this, it’s important that you complete the FORM 433A-OIC as accurately and truthfully as possible. This form is used to calculate the Doubt as Collectibility offer in compromise & the IRS uses this to analyze your current financial situation in full. The more information they have, the better they can determine if an OIC makes sense for you and your unique circumstances.

There are a few key things that the FORM 433A-OIC asks for:

-Your total income (from all sources)

-Your total expenses (for things like housing, food, transportation, etc.)

-The value of your assets (like cash, property, investments, etc.)

-Your total liabilities (including any taxes owed, credit card debt, loans, etc.)

If you’re not sure how to answer one of the questions on the FORM 433A-OIC, that’s okay! You can always reach out & we can review if your case would make sense to go through an OIC

IRS Offer Component of the Offer In Compromise: FORM 656

The IRS FORM 656 Offer in compromise is a form that is the offer component of the OIC and it is used to negotiate with the IRS for a lower tax bill. IRS form 656 Offer in compromise form can be used to reduce the amount of IRS back taxes that are owed or to settle an outstanding tax debt.

The IRS 656 Form is submitted alongside the 433A OIC form. The difference between the 2 forms is that the 433A-OIC is used as a calculation for the OIC. The 656 is a continuation, and the actual offer is made on form 656 based on the results from the 433A-OIC. It is on Form 656 where you have to request the IRS to consider the offer, and you have to list out the tax periods or tax years owed & the type of taxes owed:

1-IRS Personal Income Tax

2-Civil Penalty for Business Owners

3-Payroll Tax Liabilities

4-Employment Tax Liabilities

5-Other Types of Taxes or Civil Penalties

The IRS FORM 656 also includes the amount of the offer you are making to the IRS. The offer you make has to be an actual amount, meaning it can not be $0. This amount is brought over from IRS FORM 433A-OIC. The initial payment to the IRS would be one of the 3 following ways:

-No payment upfront if you qualify for the Low-Income Certification

-Lump Sum Payment of the Offer. 20% initial payment of your offer amount. The rest is due upon acceptance of the Offer

-Periodic Payments. Payments to the IRS for the OIC in 6 - 24 months.

In addition to the initial payment of the offer, there is an application fee due to the IRS for the Offer In Compromise. Currently, the application fee for the OIC is $205.

A tax attorney specializing in offers in compromise can help you navigate these requirements.

Wondering how much you could save with an IRS Offer in Compromise? Use our IRS Offer in Compromise Calculator to estimate your potential savings.

IRS OIC Acceptance

REQUIREMENTS & PROBATIONARY PERIOD

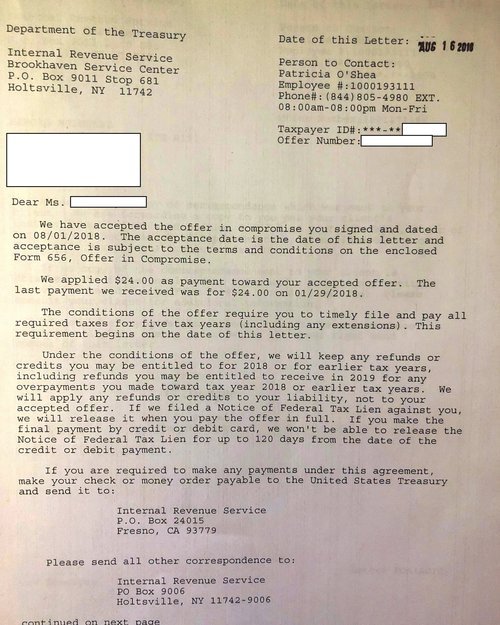

Once the IRS accepts an Offer In Compromise, you have to comply with the Offer payment terms & you begin a probationary period. For the next 5 years following the acceptance of an Offer In Compromise, you have to remain in all tax filing & payment compliance with your income taxes.

When the IRS Accepts your Offer, you have to pay the remaining amount of the offer. You will receive a letter from the IRS confirming the acceptance of the OIC. In that letter you will get a copy of the final 656 or amended 656 OIC which has the amount of deposit paid, and what the remaining amount to pay.

-

1-Pay the offer amount.

-The amount is generally negotiated through the process of the OIC, and IRS FORM 656 has the terms.

—example: When you submitted the OIC of $100, you initially paid $20 as the 20% deposit. The OIC was accepted, and IRS FORM 656 has the amount reaming of $80 to be paid in 5 months. That is the amount of the remaining amount of the offer you have to pay.

Are there any other requirements once the IRS Has Accepted my Offer In Compromise?

There is a probationary period with the IRS to remain in tax filing & payment compliance with your income tax returns for the following 5 years.

1-5 year income tax compliance commitment:

1-Timely Filing of all Income tax returns

2-Timely Payment of income tax

1-No additional taxes due past the payment deadline.

Do you qualify? We can Review your situation in depth to see if you qualify

The Offer Component of the IRS Offer In Compromise FORM 656