Why did I receive an IRS CP14 Notice?

Understanding the IRS CP14 Notice in 2025: What It Means and How to Respond

An IRS CP14 notice is a letter sent to you informing you have a balance due to the IRS.

The notice includes information about the tax year in question, the amount owed, any penalties or interest, and the due date for payment.

If you are not able to pay the full amount by the due date, the IRS may take further action to collect the debt.

You may qualify for Tax Relief or Settlement if you are unable to pay your tax debt

Why did the IRS send me a CP14 letter?

When you filed a tax return, whether it is for a past year or the current year and there is a balance due of taxes owed, the IRS sends out a letter with the amount due, this is the CP 14.

The IRS takes approximately 4-6 weeks to process an e-filed tax return, and upon processing the tax return will send out the CP14 Notice. The processing times may vary with the IRS depending on their current backlog.

If you filed your tax return by mail, the IRS takes a bit longer since the tax return is manually processed. The timeframe may take approximately 3 months to 5 months.

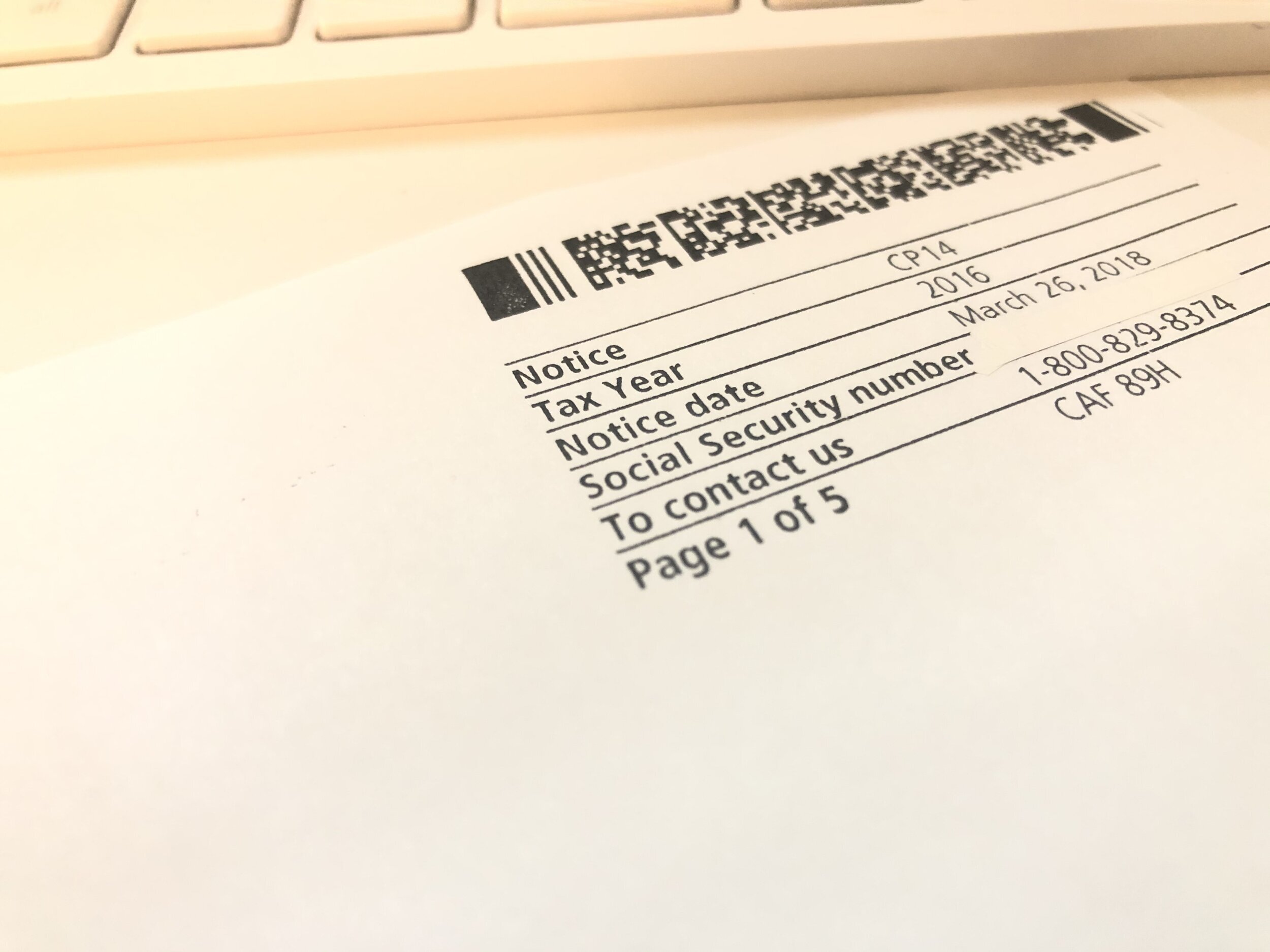

The top left of the IRS CP14’s first page contains the Address of the IRS service center that sent the notice. The Cp14 letter also has the IRS phone number of the service center on the right side.

The other information on top of the first page of the CP14’s right side contains the tax year you owe, and the notice date the IRS issued out the letter to you. If you submitted multiple years of tax returns, all with additional balances, the IRS will send out an individual CP14 for each year there is a balance owed.

The CP14 notice contains an updated balance owed to the IRS

The balance due totals the amount of tax and the following statutory amounts of Interest & Penalties:

IRS Failure to Pay Penalty

IRS Failure to File Penalty

IRS Interest Charges

The Failure to Pay Penalty or FTP is given when the taxes were not paid by the due date. This is the case even if there was an extension filed or if the tax return was timely filed. An Extension to file is not an extension to pay.

The amount of the FTP is calculated as .5% per month for not paying the tax on time. The penalty is capped at a maximum of 25% of the taxes in total.

The Failure to File Penalty or FTP is calculated as 5% penalty per month for each month, with a maximum penalty of up to 5 months.

Below is the guidance of how to get the penalties removed or forgiven. So there is some light at the end of the tunnel.

Interest is charged on all balances not paid timely to the IRS. Interest starts to get charged beginning on the date when the taxes are due. The interest rates are variable and may change quarterly.

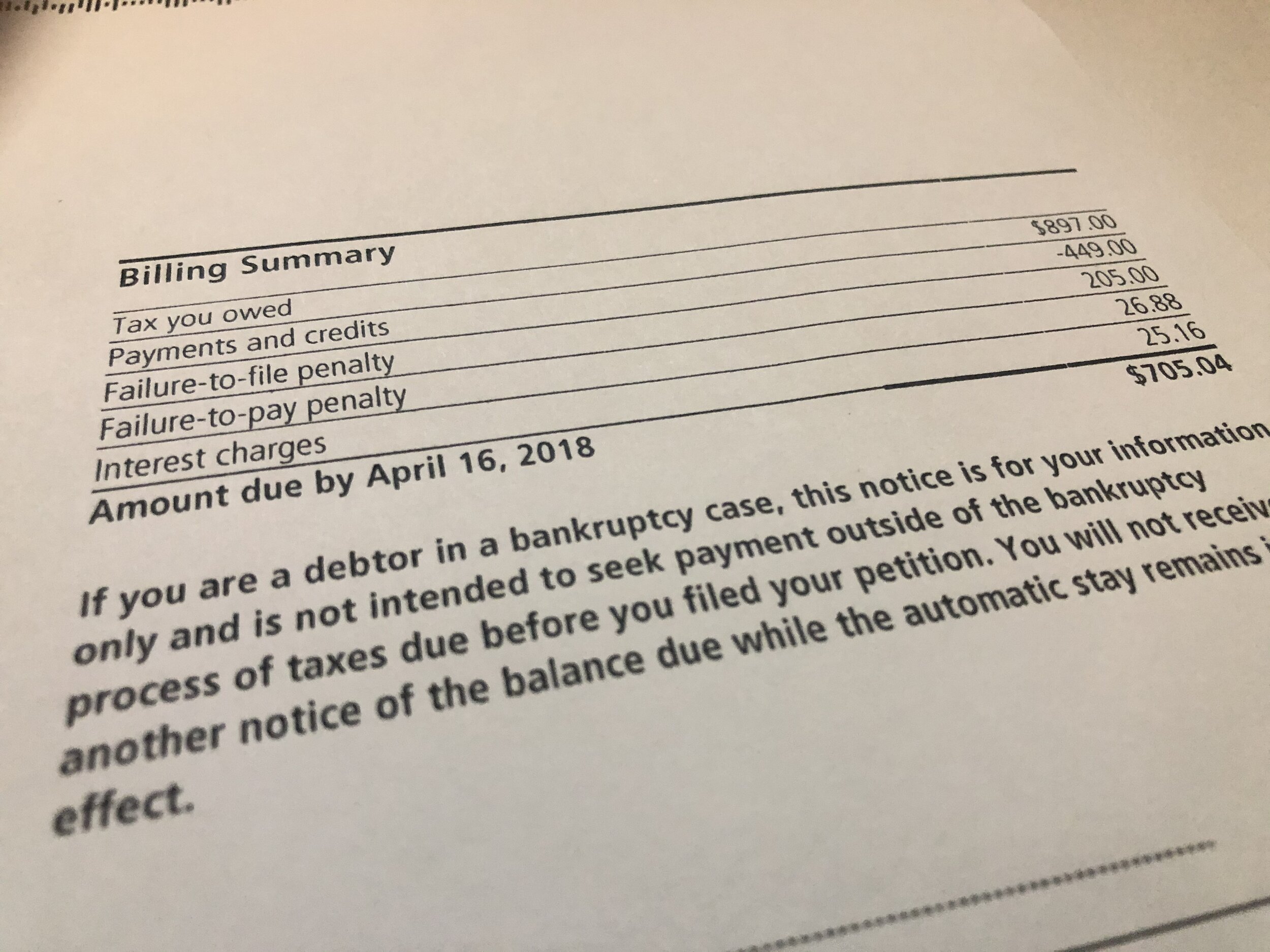

The Calculation of the amount due to the IRS, including all Penalty & interest, is located on the very first page. The Breakdown is on the Billing Summary which includes the following:

The Taxes you owed

Less any payments & or Credits

Add Failure to Pay Penalty

Add Failure to File Penalty

Add Interest Charges

Total = the amount due per the CP14 letter & the Due date of payment.

The CP14 is the first notice the IRS sends you regarding the balance owed. The bottom of the first page also serves as a payment voucher in case you submit a payment by mail to the IRS.

How can I resolve the balance owed to the IRS?

You can resolve the balance owed to the IRS in the following 7 ways:

Review the original tax return for errors & amend the tax return

Pay the balance in full ( & penalty forgiveness)

Temporary time to pay ( & Penalty Forgiveness)

Payment Plans ( & Penalty Forgiveness)

Penalty Forgiveness

Non-Collectible Status - Financial Hardship Status

1. Review the original tax return for errors & amend the tax return

This step is always important, review your income and deductions and compare that with the tax return as filed.

Getting a second opinion from a different qualified tax professional is highly recommended. This might be the case if you either filed the original tax return yourself or you had the taxes filed by a seasonal tax preparer from one of the big box tax preparation companies.

The big chain tax prep companies hire seasonal preparers who are not experts in taxes. So, a second opinion would not hurt.

If there is an error in the tax return, you can correct the tax return and file an amended tax return. If this reduces or eliminates the balance that would be golden!

However, if the tax return is correct and amending the tax return is not an option, then you will have to review one of the other ways to fix the IRS balance.

2. Pay the balance in full ( & penalty forgiveness)

If the CP14 is accurate compared with the original tax filing, paying the taxes in full is an option. When making the payment, it can be made online with a checking account, or a credit card or send a payment through the mail by check or money order.

if you will be paying the balance off, you have to make sure you pay the correct tax year in question. If you just send a payment to the IRS without the tax year in question, the IRS might apply the payment to a different tax year, and you might just end up in collections.

Penalty forgiveness might also be available even if you pay off the balance in full. The forgiveness of penalties is detailed below.

3. Temporary time to pay ( & Penalty Forgiveness)

The IRS can grant you a temporary time to pay, up to 120 days to pay the balance in full.

You can request the IRS to grant you a certain amount of time to pay the taxes in full.

This option allows you 4 months to pay the balance. Keep in mind, only choose this option if you are 100% sure you can pay the IRS in the time frame requested.

Once you make the payment, you may qualify for the forgiveness of penalty which is detailed below.

4. Payment Plan ( & Penalty Forgiveness)

The IRS can grant you an installment agreement. There are different types of payment plans offered by the IRS. All of the payment plans once approved, will require you to file future tax returns on time, and not owe an additional amount.

If the balance is under $25,000, the IRS will accept a 72-month payment plan where you can make the payments yourself before the due date.

If the balance is over $25,000 and under $50,000 the IRS will also accept a 72 payment plan, however, the payments must be through direct debit from a checking account.

When the balance is over $50,000 and under $100,000 the IRS can accept an 84-month payment plan, however, they will file a federal tax lien against you.

Another option is to request a financial hardship payment plan. Under a hardship payment plan, the amount you owe to the IRS does not matter. What matters is only your current finances.

This method works like this: Let’s say you owe $100,000 ( One Hundred Thousand Dollars). However, you can only afford a payment of $50 (Fifty) per month.

The IRS will accept the payment plan, however, your financial situation will have to be disclosed, including Income, Asset, Liabilities, and expenses.

If the hardship payment plan gets approved, the IRS may also file a federal tax lien against you.

5. Penalty Forgiveness

The penalty that has been added for either failure to file or failure to pay may be forgiven. The penalties are added as a way to punish you for either not filing on time, not paying on time or both.

The forgiveness of penalties by the IRS is created as a way to offer you an opportunity to reward you if you have had a good filing history or if you have faced hardship or there is a reasonable explanation to the late filing or the late payment of the taxes.

If you have had a good filing history for the last 3 years, where you filed your tax return timely and generally had refunds or paid your tax balance before tax day, then you might be a candidate for the “First Time Penalty Abatement”

Another method of requesting the penalty be forgiven is if you have faced some kind of hardship that prevented you from paying the taxes.

Hardship can be one of the following:

Medical Hardship such as an unexpected illness or surgery

Financial hardship such as a loss of a job

Death of an immediate family member

The IRS also offers the forgiveness of Penalty if you received wrong tax advice from a tax professional, and because of that advice you ended up owing the balance to the IRS

One other method of getting the penalties forgiven if you received erroneous written advice from the IRS. IF this occurs, you will qualify for the forgiveness of the penalty.

6. Offer In Compromise

The IRS has a complete tax forgiveness program, known as the OIC, or Offer In Compromise. There are three types of Offer In Compromise: Doubt as to collectibility, Doubt as to liability & effective tax administration.

This program exists to give an opportunity and to wipe out the balance owed to the IRS down to nothing, zip, zero ($0).

There are requirements and eligibility guidelines to meet the standards of the OIC.

If the taxes are forgiven through the program, there is also a 5 probationary period the IRS will monitor your tax filing and no additional taxes owed. So the goal moving forward is file on time, and not owe an additional tax at tax time.

The most popular program of the OIC is the doubt as to collectibility. The guidelines are based on your disposable income, assets, liabilities and living expenses.

A sample of the IRS OIC works like this:

A calculation shows your offer amount is calculated at $100.

You owe the IRS $45,000.

The IRS accepts your offer of $100.

You pay the $100 & the IRS forgives the $45,000.

The big requirement is the eligibility guidelines and your current financial situation.

7. Non-Collectible Status - Financial Hardship Status

There is a financial hardship program known as Non-Collectible Status or CNC.

CNC is an excellent program where you are placed in a protected status because of your current financial hardship situation.

CNC is a great solution for those who will not qualify for an offer in compromise, yet can not afford to pay the taxes.

CNC allows you to continue to pay for living expenses without the worry of any type of IRS collection action.

In conclusion, take action when the IRS sends the CP14 letter. Respond promptly. Take control of the situation. Review your options and tackle the IRS problem before it gets out of hand.

How will you resolve the balance from an IRS CP14 letter?

IRS CP14 Notice FAQs

-

The IRS CP14 notice is a letter from the IRS informing you that you owe money to the IRS for a particular tax year.

-

You received an IRS CP14 notice because the IRS processed your tax return and determined that you owe money for that particular tax year.

-

The IRS CP14 notice will state the original amount of tax owed, any penalties or interest that have been added, and the total amount due.

If you have additional IRS tax balance, the CP14 will not list the amounts. The CP14 notice is only specific to 1 tax year.

-

The IRS CP14 notice will include the due date for payment, which is typically within 21 days of the date on the notice.

-

If you don't pay the full amount owed by the due date, the IRS may take further action to collect the debt, including placing a lien on your property or seizing your assets.

You may qualify for a tax relief program such as the Offer In Compromise, Non Collectible Program or a Hardship payment plan.

-

If you believe the amount of taxe is incorrect, you have the right to dispute the amount with the IRS.

Several options exist to dispute the amounts such as an amended tax return, Identity Theft Claim, or a doubt as to liability program. The burden of proof is up to you to show the IRS.

-

If you can't pay the full amount owed by the due date, review your original tax filings to see if an amended tax return is possible or if one of the following tax relief programs may apply:

1) Temporary time to pay ( & Penalty Forgiveness)

2) Payment Plans ( & Penalty Forgiveness)

3) Penalty Forgiveness

4) Offer In Compromise

5) Non-Collectible Status - Financial Hardship Status

-

The IRS CP14 is considered the initial notice sent out when there is a balance owed to the IRS. If you do not respond to the IRS CP14 by the due date, the IRS will definitely send a follow-up notice.

The actions of the IRS will increase and get more aggressive. The IRS may assign your account to the collections department of the IRS, known as “ACS”.

When ACS takes over your account, they mean business. The job of ACS is to collect on what is owed.

The collections department of the IRS needs to send out certain letters to you as a legal warning. These legal warnings are mandatory and required before the IRS is able to take any action against you.

Once the IRS sends out the legal notices to you, the IRS will then have the authority to begin collections actions such as Bank account levies or wage garnishments if the balance is not resolved in a timely manner.

From the time the IRS sends you to collections to the time they have the authority to take action is approximately 4 months. The last notice will be sent through certified mail, and the letter will state the final warning.

The best way to deal with this problem is head-on, and for you to take action before the IRS takes action