How to remove IRS tax penalties in 3 easy steps.

A Comprehensive Guide on Getting rid of your IRS Penalties

As a Tax Professional, I have successfully gotten rid of Millions of Dollars of IRS Tax Penalties on behalf of my clients. This is the 3 step strategy I have used to accomplish getting the IRS to forgive your Tax penalties. This can be used whether the IRS Penalties are $50 or $5 Million. Dealing with IRS Tax Debt is such a pain, especially with the extra Penalties added to your balances: Failure to File, Failure to Pay, Accuracy Related, Substantial Understatement & the list goes on. However, It Is very possible to get rid of IRS Penalties.

TLDR | Key Takeaways

Pre-Abatement: IRS Tax Filing Compliance & Resolution ( Don’t Skip this step, its the key!)

Abatement Request Under First Time or Reasonable Cause: IRS Form 843

Organized Packet with Penalty Abatement Cover to the IRS & Follow Up Until Decision Rendered.

If you are looking for the Complete Tax Debt Reduction, Elimination or Settlement Guide - Click here to access

Step 1: IRS Tax Filing Compliance & Resolution

You Can’t Skip this step! Step 1 is what I call IRS Pre-Resolution or in this case, Pre- Abatement. If you skip this step and proceed with just making the abatement request, the IRS will immediately will tell you to kick rocks. There are there are 3 things to do prior to making the request., which lay out the foundation for future compliance & nlock the door to Penalty Forgiveness

IRS Tax Filing Compliance ( Have All Taxes filed)

Have Corrected Withholding ( Fix the W4 at work or make ES payments if Self Employed)

Request an Installment Plan, Fresh Start Program with the IRS or Pay the IRS Tax Debt in Full.

The first thing to do prior to making the request to the IRS to forgive the penalties is to get all your tax filings in order. If you already have this done, then you can go on to the next step.

However, if you have missing past tax years, you would need to catch up on all the tax filings, get them submitted and the IRS should process all the past years.

The second thing to do prior to making the request to the IRS to forgive the Penalty is to fix the original error of owing a tax to the IRS. This means the next time file, you will not owe the balance to the IRS.

Having more taxes taken out of each check. You can do this by adjusting your withholding on your w2.

If you are self-employed, you have to make the required estimated tax payments that serve as deposits for tax time. Evey time you file the current taxes, it begins a new cycle of ES Payments.

The third thing to do before making the request to the IRS to forgive the penalty is to be on an Installment agreement such as the Fresh Start agreement or to fully pay the balance owed to the IRS.

If you qualify for some other IRS tax resolution program or settlement, then the penalty forgiveness does not apply. This means that if you qualify for an Offer in Compromise, that program completely eliminates the entire tax, interest & penalties therefore the penalty abatement will not apply.

However, if you qualify for a payment plan with the IRS, then the penalty forgiveness is ripe for you. Having the Penalties forgiven will lower the balance owed, and will make it much easier to pay off the balance to the IRS.

You can also make the request for penalty forgiveness after you have paid off the entire amount of the taxes, penalties & interest. You have 2 (two) years to receive a refund on payments made to the IRS.

Now that all 3 things above have been met, it is time to move to the next step.

Step 2: Reason you are asking the IRS to forgive the Penalties.

Reasonable Cause or;

First Time Abatement ( *If Applicable)

The IRS will abate the Penalty if there are good excuses, or “Reasonable Cause”. If there is no Reasonable Cause, the First time abatement might apply for the IRS to abate the tax penalties.

There would be many reasons, or excuses permitted by law that the IRS would forgive the penalties. The IRS calls these excuses “ Reasonable Cause”.

Reasonable Cause for IRS penalty forgiveness may include any the following reasons:

Medical Hardship

Financial Hardship

Death of a family member

The mistake was made on the calculation of the taxes

Error on behalf of a tax preparer or wrong advice from a tax preparer

Wrong advice in writing provided by the IRS

**COVID 19 Related hardship (including local law enforcement)

If none of the above reasonable causes applies, there is still hope. The IRS has a the first time abatement program known as the “ First Time Penalty Abatement”

The First Time Penalty abatement program reviews the 3 preceding tax years for the requested tax year. If there are no assessed penalties in the 3 preecedding years, the IRS will grant the Penalty Abatement Request.

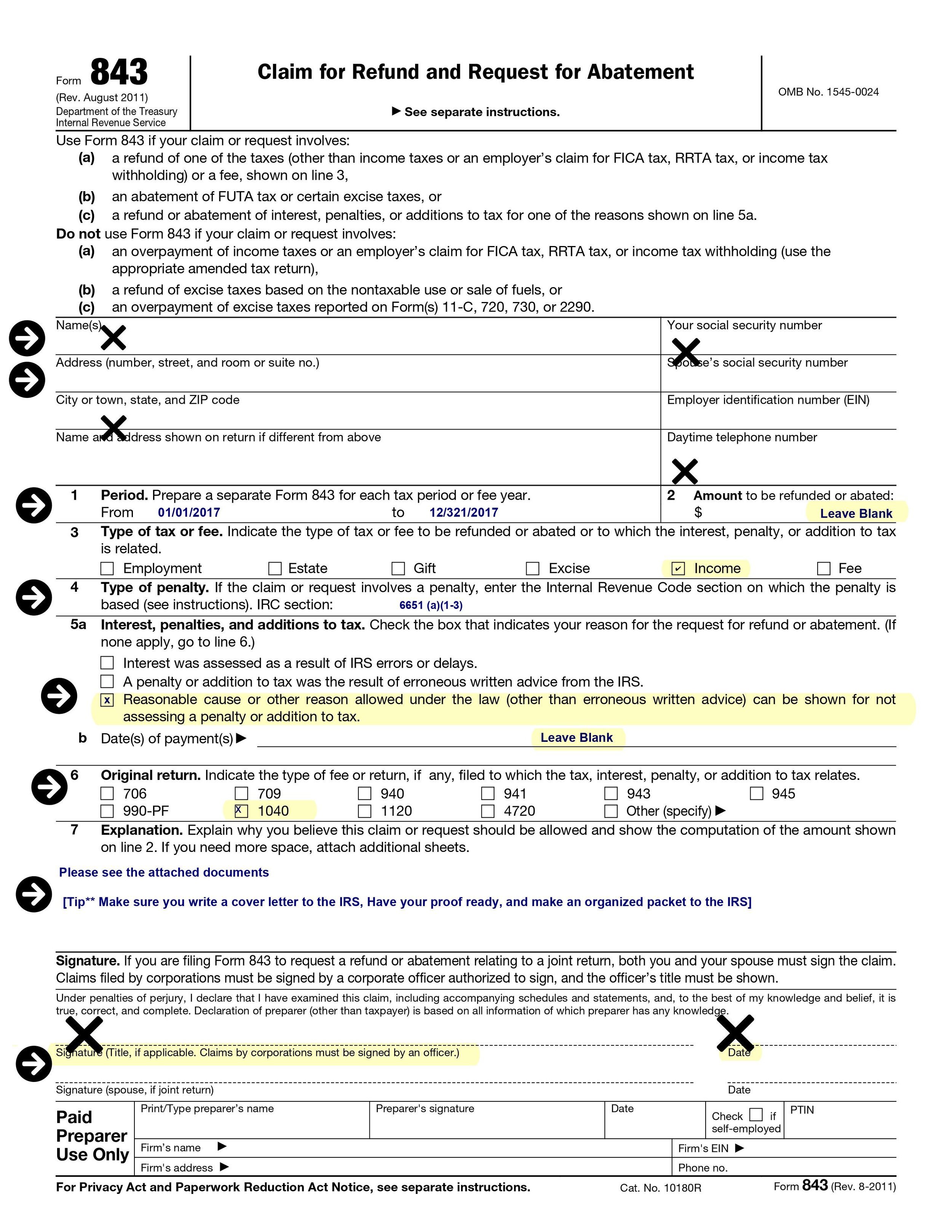

Which IRS Forms are required to request to the IRS to forgive the Penalties?

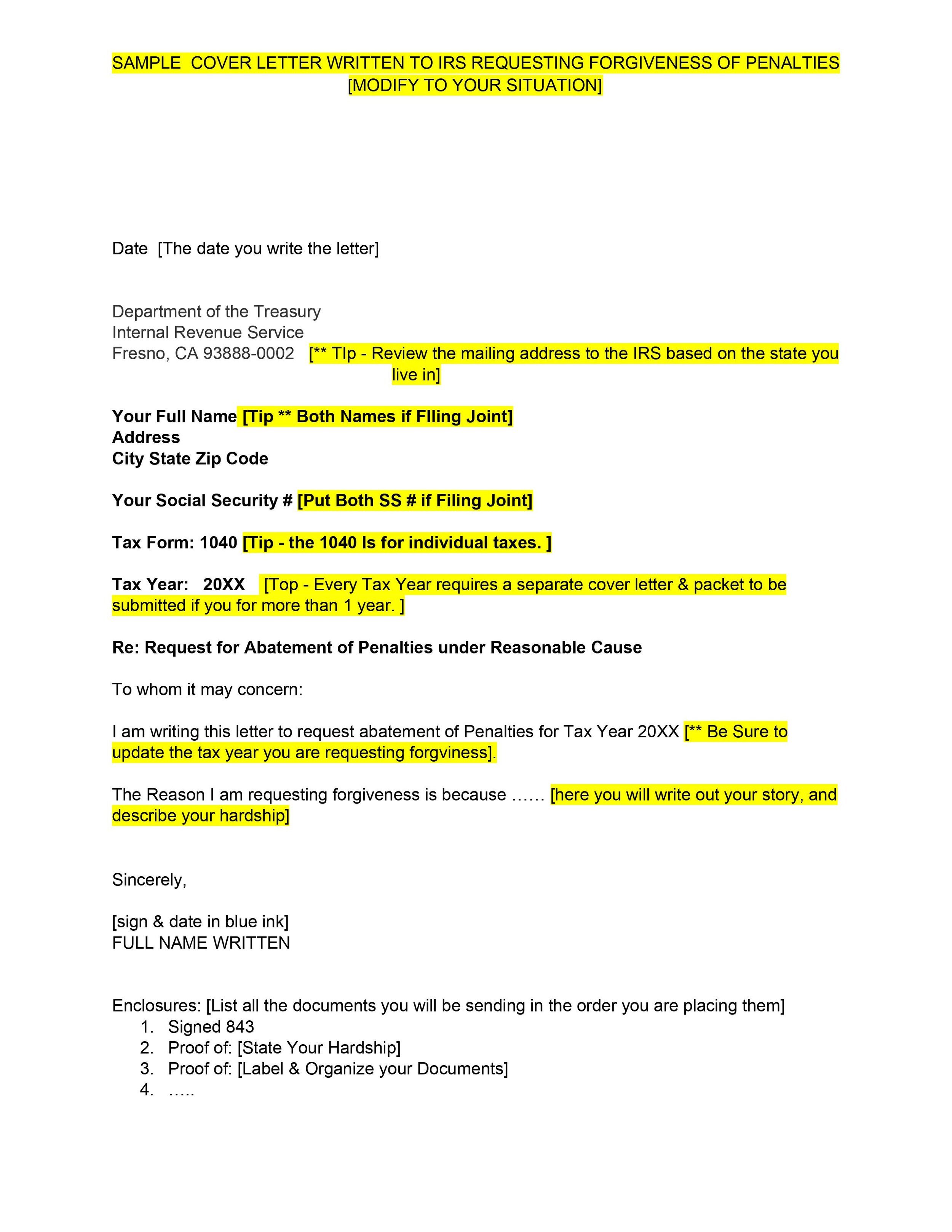

IRS Form 843 is required to be filled out and submitted to the IRS for the penalty abatement. However, you can also write out a good cover letter that covers the same topics as Form 843.

In Addition, to FORM 843, you have to submit proof of any reasonable cause of hardship. The proof can be anything you have that proves you really had the reasonable cause in that specific time frame.

Some hardships are tied with each other, so it would be ok to submit a hardship for Medical hardship & financial hardship in 1 packet.

Some examples of the types of proofs are:

Medical Hardship: Hospital Appointments, Hospital Stays, Prescriptions, Doctor’s Diagnosis…

Financial Hardship: History of Layoffs, unemployment, Bank overdrafts, Utility shut-offs, evictions, home foreclosures, car repossessions

Death of a family member: The death of an immediate family member would generally be a parent, sibling, or child. You would have to submit proof of the relationship as well as the death certificate.

The proof of the reasonable cause would be all up to you to gather. The IRS really has no idea what occurred in your life, so it would be up to you to show them.

Under the first time penalty abatement, you are basically just making the request to the IRS to simply forgive the penalty, without any reasonable cause. The IRS may review the 3 most recent years for filing compliance. Making the request is worth the shot!

If you owe the IRS penalties for multiple years, you would have to submit a different request for Each year that there is a penalty. Each request is independently reviewed by the IRS.

Now that you have completed the reasons why the IRS would forgive the penalties, it is time to put it all together and make the request.

Step 3: Submit the Request to the IRS for Penalty Abatement

You can make your request either by phone or mail to the IRS. If you make the request to the IRS by phone, that would avoid the typical 60 days for the IRS to respond to your request. Normally you would make the request by calling the collections dept of the IRS or responding to the letter that the IRS sent you.

Making the request over the phone, you may encounter the IRS simply to tell you that you would need to make your request in writing, by mailing the forgiveness request packet.

Before you put the documents in the mail, it is important to do a good organization of the documents. Having an organized packet will be much appreciated by the IRS official who will be reviewing your request. If you submit a disorganized bunch of paperwork, the IRS official will be fishing for answers and the IRS agent might be discouraged to approve your request.

Organziation should be:

Form 843 as the first page

A cover letter summarizing how you qualify for relief, and the list of documents you are sending as proof of your reasonable cause

Use a separating, Colored, cover sheet in between each document

Place organized documents in a large envelope. The mailing address where you are mailing your documents is the same as the IRS service center that processed tax returns.

You can find the mailing address to the IRS by clicking here.

Once you place it in the mail, the IRS will respond to your request. Typically they respond in approximately 60 days. However, with the COVID-19 pandemic, there might be delays in the response.

If they approve your request, excellent!

However, if the IRS denies your request to forgive the penalty, review the letter thoroughly as to the reason why. If you find that you have additional documentation, make the request once again. Or, if you get denied under the first-time penalty abatement, you can try again after the next time you file your tax return.

The IRS has a harsh punishment on those who file late tax returns, and those who do not pay the taxes on time. The IRS Penalties apply to individual tax filers & businesses.

There can be many reasons why you owe the IRS, and how the penalty got assessed to you. All of that can be forgiven!

The penalties are stiff and can really add up, making it difficult to pay off the balance with accrued penalties.

2 of the most common penalties are the Failure To Pay ( FTP) Penalty & the Failure To File ( FTF) Penalty.

The great news is that the IRS offers relief for penalties. You can make the request to the IRS to get rid of the IRS Tax Penalties through forgiveness, known as penalty abatement.

The important thing to do moving forward is to keep in tax filing compliance. File all future taxes on time, correct the amount of taxes withheld throughout the year, and pay any amounts due prior to deadlines.

We would love to hear your success stories on filing a penalty abatement.

Need help submitting a Penalty abatement request? We can review your case! To get started & schedule your free case review with an Orange County Tax Attorney, just click below!